How to Use a Zero-Based Budget (ZBB) for Your Home

What is Zero-Based Budgeting (ZBB)?

Zero-based budgeting, or ZBB, is a budget created to account for every dollar of income. With a zero-based budget, your income minus your expenses and savings will be zero. By using this type of budget, you are assigning each dollar you bring in to an expense.

Zero-Based Budgeting:

Income – Expenses = 0

Note: This post may contain affiliate links, which means if you buy from my link I might make a small commission. This does not affect the price you pay. See the full affiliate disclosure here.

For example, if you bring in $5,000 each month, you will need to “spend” $5,000. This doesn’t mean you actually have to spend the whole $5,000. You can choose to “spend” a certain amount on savings and add it to your account.

What are the Advantages and Disadvantages of Zero-Based Budgeting?

The advantages of a zero-based budget are that it accounts for every dollar, it is precise, and it lets you see where your money is going at the beginning of your budgeting period. You are essentially spending your money into each expense category at the beginning of the period. When you know exactly where your money needs to go, it’s easier to stick to your budget.

The disadvantages of zero-based budgeting are that it can take a lot of work up front, you have to follow-up with you purchases and expenses, and there is no room for error. This type of budget takes work. You’ll need to create your budget at the beginning of the period, track your spending, and adjust as needed to make sure you end up with a zero difference at the end of the period.

So, while zero-based budgeting can be extremely accurate and efficient, it can also be time-consuming and tedious. If you are prudent about making your budget work, you can master the zero-based budget with some practice.

How to Create a Zero-Based Budget (ZBB)

- List your income

- If you have a variable income, you can make your best guess and adjust this number when you know the exact amount.

- List all your expenses

- All expenses include your bills, spending budgets for things like food and gas, and other expenses for things like gifts and giving.

- Some of these may be variable expenses. You can make your best guess from the average amount and adjust when you know the exact amount.

- Subtract your total expenses from your total income

- This is the amount of extra money you have for the period. You’ll need to allocate this.

- List your savings or extra debt payments

- This section is meant to tell your additional money where to go. Most often people send their extra money to a savings account or to pay extra toward a debt.

- You can include this section in the above expenses. However, I like to create this section separately because it is my “optional” section where I get to choose where my extra money goes.

- Make sure that your income minus your expenses and any additional savings or debt payments equals zero.

- Income – (expenses + additional savings/debt payments) = 0

- Track your spending throughout the period and record the actual amounts in each category.

- Make any adjustments to your optional categories (extra savings or debt payments) to make your balance equal zero.

Free Zero-Based Budget Template

Grab your free zero-based budget PDF template here so you can follow along with the example below. Fill out the form below to join my newsletter and get a blank budget template.

[convertkit form=2906387]

Zero-Based Budgeting Example:

Creating Your Zero-Based Budget (ZBB)

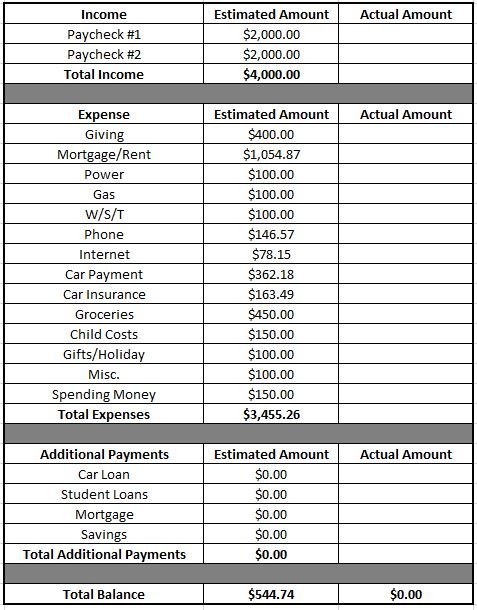

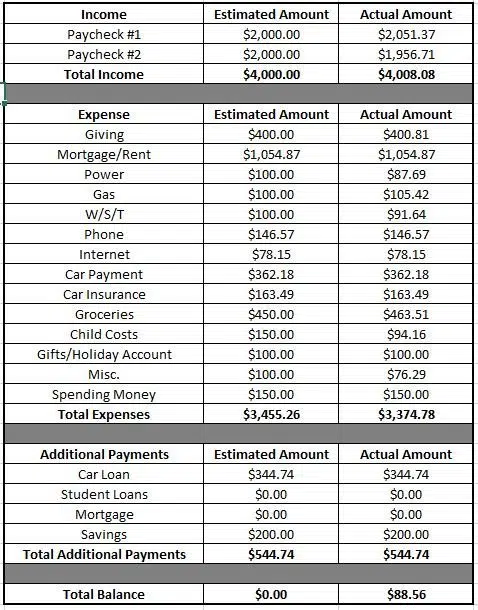

Chart #1 (steps 1-3)

This stage of the budget shows steps 1-3 from the section above. I have listed our estimated income in the top section. In the second section, I’ve listed our estimated expenses. Some of these, like the mortgage payment, phone payment, and car payment are the exact amounts I know we will pay. Others like utilities I have made my best guess on based on our past payments.

My total estimated income is $4,000. Estimated expenses are $3,455.26. This leaves a $544.74 balance that I need to allocate.

Chart #2 (steps 4-5)

This stage of the budget shows steps 4 and 5 from the section above. It’s up to you what you do with the leftover balance. You could give yourself some extra spending money, donate, or whatever you’d like depending on your goals. I am choosing to use the leftover balance to pay an additional amount toward our car payment and put some into our savings account.

Just make sure that you are spending the balance. For example, my leftover amount was $544.74. So, I am spending $200 on my savings and $344.74 on an additional principal payment on our car loan.

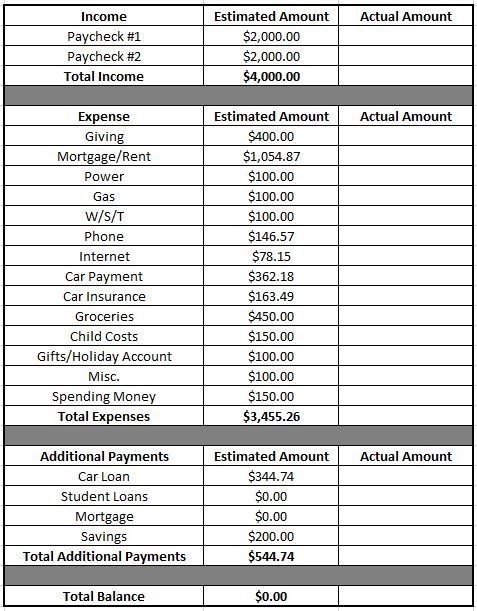

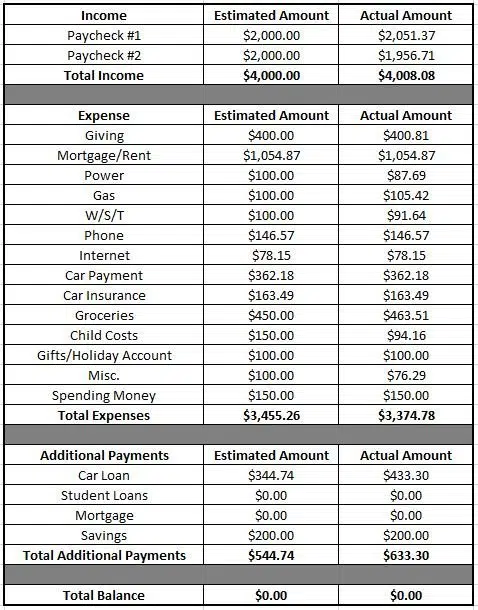

Chart #3 (step 6)

During step 6 of zero-based budgeting, you will track all your spending and record the actual amounts in each category. It’s okay if these are different from what you estimated. Over time you will be able to accurately estimate your budget once you learn how much you have been spending in each category.

Chart #4 (step 7)

Since you are most likely not able to estimate your initial budget down to the penny, you will have a balance leftover once you’ve recorded your actual spending. During step 7, you will need to adjust your additional payments to make your balance equal zero.

If you end up with a negative balance, you have overspent by exceeding your income. You’ll need to tighten your budget next time or you’ll accumulate debt this way.

The chart above showed a new balance of $88.56 that was leftover from our actual spending. That means that I need to add that to a category. Since our goal is to pay off our car loan as quickly as possible, I have added the $88.56 to the extra car payment.

How to Stick to Zero-Based Budgeting (ZBB)

In order to be successful with your zero-based budget, you need to stick with it. This type of budget requires that you sit down before the beginning of the period, which is typically a month, and create your budget. You then need to track your spending during the month and record it.

This means that you cannot spend without recording. You can record as you go or you can catch up at the end of a week or when you have time. I find it easiest to pick a day each week to go over expenses. You can also keep a log of common expenses like personal and grocery that you can write down as you go. If you wait too long, you may forget what some purchases were for.

Make sure that you follow up with your budget! It’s easy to sit down and make the initial budget. Most people fail at the part that involves tracking and follow up. Pick a day at the end of the period and make sure you balance your budget and move your remaining money where it needs to go.

Zero-based budgeting can be tedious. However, the more you use this budget, the easier it will become. You’ll find what works and what doesn’t. Scheduling times to work on your budget is essential to your success.

Is Zero-Based Budgeting (ZBB) Right for You?

Now that you’ve seen how zero-based budgeting works, is it right for you? If you can stick with creating and adjusting your budget each period, this type of budget can be great. I love zero-based budgets because they can be helpful in achieving financial goals. You are forced to spend your extra money on what really matters to you. When you decide where your money is going ahead of time, it is easier to stick to your budget.

Are you using zero-based budgeting for your personal financial goals? If not, which type of budget are you using? Let me know in the comments!

Are You Using Zero-Based Budgeting to Achieve a Savings Goal?

I think savings goals are vital to achieving financial happiness. We’ve used savings goals to buy homes, pay off debt, and save for the future. I’ve put together several savings charts that you may find useful when you’re allocating your money for the month.

Check out these posts on saving money: